More than $3.5 billion is invested in Community Funds, Inc. and The New York Community Trust. Learn more about how these assets are invested below.

Investment choices within Community Funds, Inc.

Download the Q3 2025 Performance Report PDF

1. Vanguard Federal Money Market Fund

The Vanguard Federal Money Market Fund is chosen by donors who expect substantial near-term payouts or for those who would like a liquid allocation within their investments.

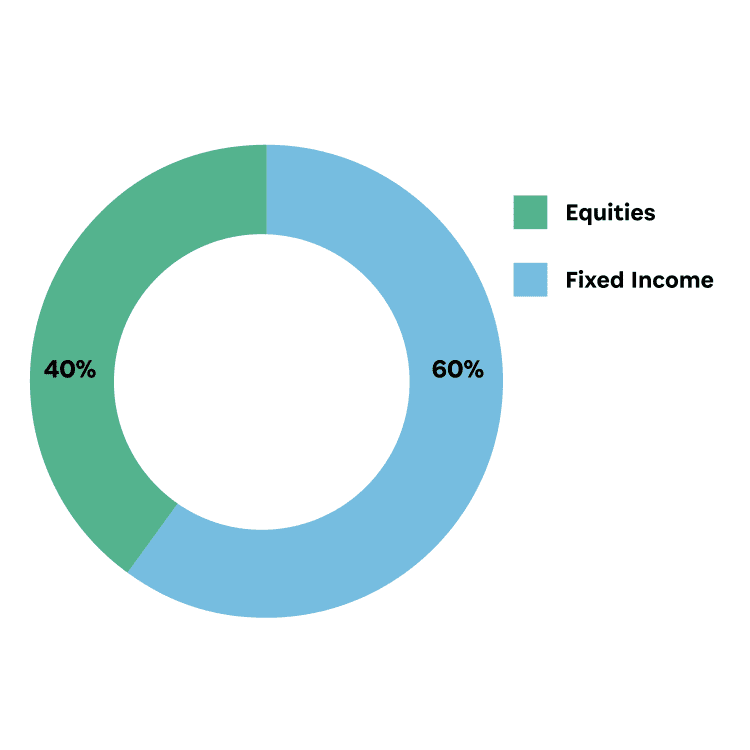

2. Vanguard LifeStrategy Conservative Growth Fund

The Vanguard LifeStrategy Conservative Growth Fund offers donors exposure to a mix of bonds and equities that generates current income while protecting principal. This Fund is typically selected by donors who have a payout time horizon of 10 – 15 years or less. The Fund invest in four other Vanguard Funds that have a 60% allocation to U.S. and international fixed income, and a 40% allocation to U.S. and international equities.

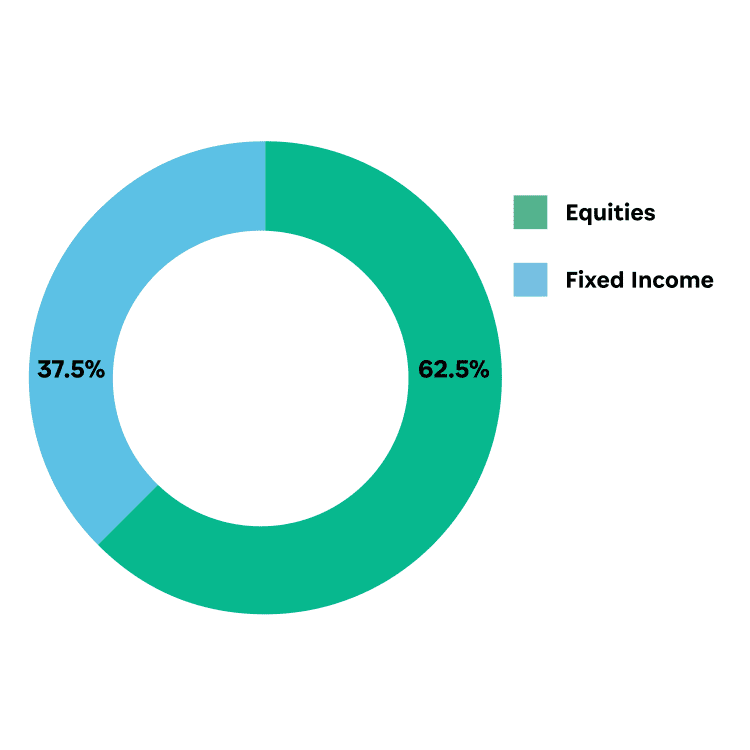

3. Vanguard STAR Fund

The Vanguard STAR Fund seeks to provide long-term capital appreciation and income by investing in a balanced allocation of stocks, bonds, and short-term investments. The Fund invests in several actively managed Vanguard mutual funds, rather than in individual securities. Similar to the CFI Pool, the Fund is most appropriate for donors whose funds have an infinite investment time horizon. Unlike the CFI Portfolio, the Fund offers daily liquidity.

4. Vanguard FTSE Social Index Fund

The Vanguard FTSE Social Index Fund offers donors a socially screened investment option. The Fund tracks the FTSE U.S. Choice Index, a benchmark of large and mid-capitalization stocks that are screened for social criteria such as workplace issues, environmental issues, product safety, human rights, and corporate responsibility. This Fund is 99% invested in U.S. equities and tends towards a growth orientation.

5. Community Funds Investment Pool

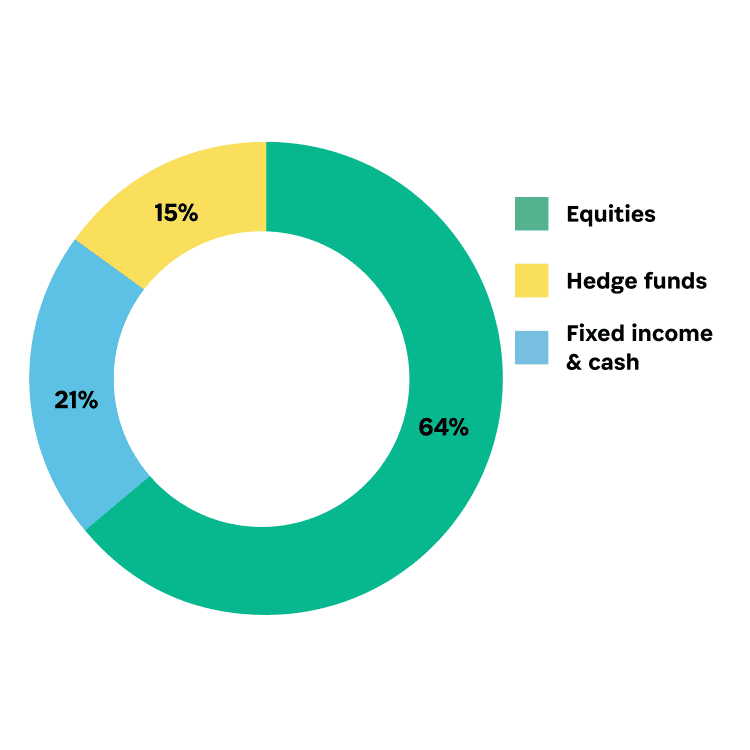

The Community Funds Investment Pool is suitable for donors whose funds have an infinite investment time horizon. It aims to produce a return which provides for current grantmaking while also ensuring the ability to make future grants. The Pool is managed in-house and is allocated to both public and private investments across the globe. Up to 17% of the Pool may be allocated to private investments. This is the most illiquid investment vehicle offered to donors. The CFI Pool has investment minimums and is primarily reserved for funds that do not allow for the invasion of principal. Transfers in and out of the Pool occur only on the first business day of each month.

The New York Community Trust currently has 12 financial institutions that participate in our trust structure. These banks and trust companies have each been approved to serve as trustee of certain charitable trusts that are governed by a “Resolution & Resolution and Declaration of Trust creating The New York Community Trust (the “R&D”), which is incorporated by reference in each of the component trusts and lays out the governance framework of the structure. Under this framework, our participating trustee banks are responsible for the custody and investment of the assets of the separate trusts they hold (which vary in number across the participating banks), and our Distribution Committee is responsible for grantmaking from the trusts. This bifurcated structure is the original structure of community foundations, dating back to the early 20th century.

The number of financial institutions participating in The New York Community Trust has waxed and waned over the years, largely due to corporate mergers, and the structure is not commonly used for new funds established with us, as the trust form is less flexible. But close to half of The Trust’s assets are held in trust form, most of which are permanent field of interest funds. For each of our funds in trust, the Distribution Committee directs the relevant trustee bank on how much to distribute to the fund’s disbursing account, and then grantmaking is handled according to the specific terms that fund.

In order to provide a means for coordination among the trustee banks regarding their role with respect to certain collective administrative matters, the R&D provides for a Trustees’ Committee, whose members consist of the CEO of each trustee bank, though the CEO can appoint an alternate to serve in their place.

The assets of the component trusts are consolidated with the assets of our not-for-profit corporation Community Funds, Inc. for the purposes of our financial statements and Form 990.

Participating Trustee Banks

- Bank of America

- Bessemer Trust Company

- BNY Mellon

- Brown Brothers Harriman Trust Company

- JTC Trust Company (Delaware) Limited

- Deutsche Bank Trust Company

- Fiduciary Trust Company International

- HSBC Bank USA

- JPMorgan Chase Bank

- Neuberger Berman Trust Company

- Rockefeller Trust Company

- Stifel Trust Company

Investment Committee

Our staff experts are guided by dedicated, seasoned investment professionals who volunteer countless hours as members of our Investment Committee.