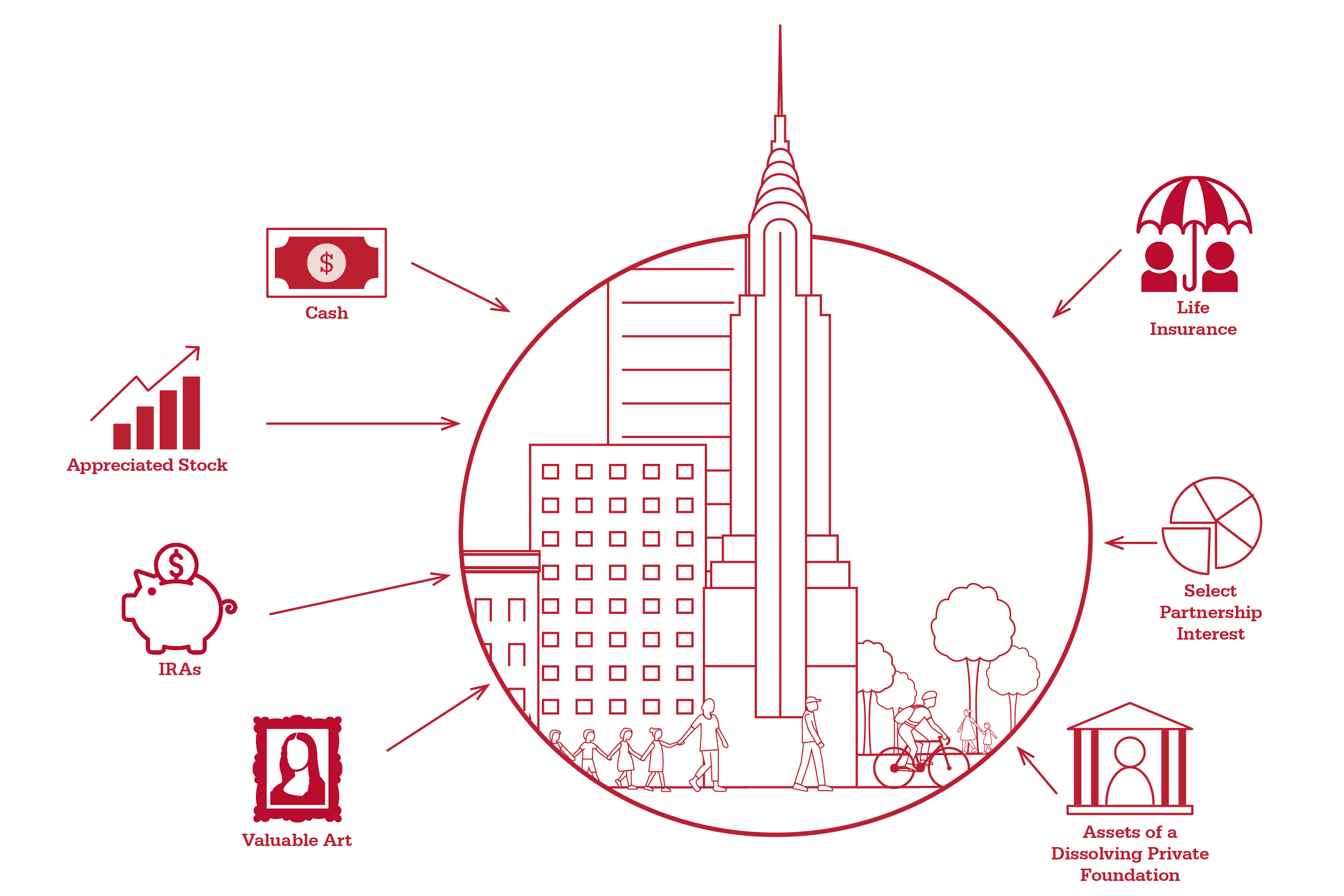

You know how easy it is to give cash. But have you considered whether you might have other assets you can turn into philanthropic resources? Your generosity can provide local nonprofits with the resources they need to help our region recover and rebuild as a more just and equitable place to live and work.

We appreciate appreciated stock: You see a double tax advantage when you give a gift of appreciated securities that you’ve owned for more than a year. The full fair market value is deductible as a charitable contribution, and you avoid paying tax on the built-up capital gains.

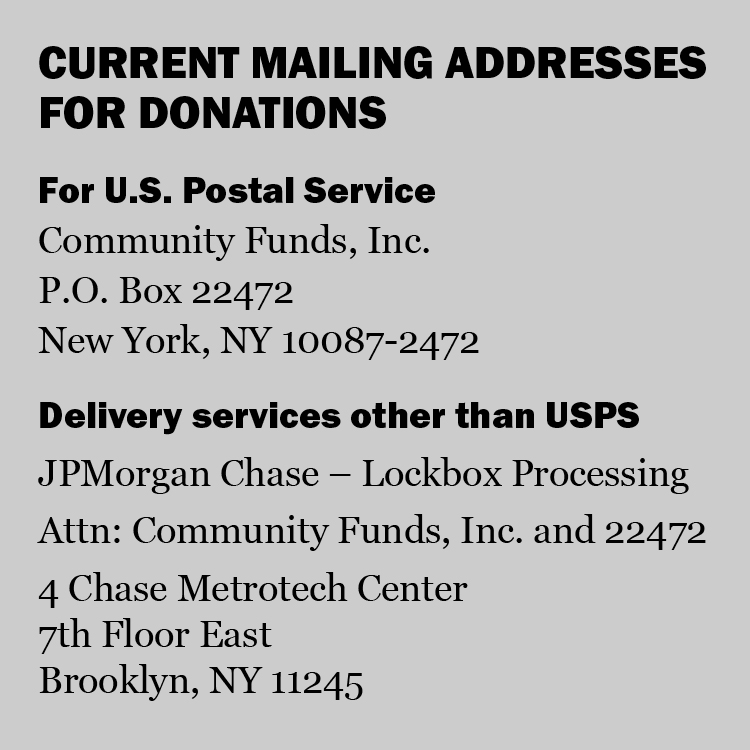

Give the gift of life insurance: Have a paid-up life insurance policy you no longer need? Make The New York Community Trust the owner and beneficiary of the policy during your lifetime. If you don’t care about an income tax deduction for the gift, you can simply name The Trust as your beneficiary of a policy at death. Please note our legal name for this purpose should be “Community Funds, Inc.”

Convert your IRA into impact: Donors aged 70-1/2 or older may make contributions from an IRA directly to a public charity such as The Trust. The “charitable IRA rollover” allows you to exclude the IRA distribution from taxable income—instead of taking it into income and claiming a charitable income tax deduction—under certain circumstances.

To qualify, the distribution must be made directly from your IRA to The New York Community Trust and must not go to a donor-advised fund. Each financial institution has its own form to process these distributions, so please inquire with your IRA custodian.

You will need to provide them with our information, including our legal name, “Community Funds, Inc.,” our EIN: 13-6089923, and our address: 909 3rd Ave., New York, NY 10022. Your custodian should also note the purpose of gift. For example, you can support our Emergency Fund (or, you can contact us to discuss how you’d like us to allocate your gift).

For further information on any of these ways to turn assets into impact, please call (212) 686-0010 x363 or email us at giving@thenytrust.org.